Every year in December we get a few calls from potential clients who are desperate to make sure we can do a donation appraisal for them before the end of the year. Usually, they’ve had a recent meeting with their accountants who suggested a noncash charitable contribution as part of a tax-reduction strategy. Of course, the most desperate callers are phoning in mid-late December. So, every year we get the opportunity to walk at least a few potential clients through the rules that apply to such donations. I thought providing a simple set of instructions here might be of help.

First, we, the appraisers are not the first call to make. The first call/s to make are to potential 501(c)3 charitable organizations to whom you are considering donating. The appraisal can be done at any time after the donation is accepted up until the filing of your taxes for the year. If the appraiser is called first, the appraisal for charitable donation is only valid for six weeks prior to a donation being made. If the donation is made later than six weeks from the effective valuation date of the appraisal, the appraisal is invalid. Call us after the artwork has been accepted for donation.

Here a few items to be aware of when considering a charitable organization:

· The Charitable organization has to be a valid 501(c)3 organization.

· Your donated items have to meet the “related use” clause, meaning if you are donating artwork, showing artwork must be within the donee organization’s purposes. The organization does not have to be an art museum. But showing art and maintaining an art collection must already be a part of their agenda as an organization, at least to some capacity. Many hospitals, universities and other schools might qualify. So, some thinking outside the box can help you find the right charitable organization.

· The donee must keep the artwork for a minimum of three years. Giving artwork to your church or synagogue’s yearly fund-raising dinner does not qualify. That’s still charitable giving, of course. But the donor will only be eligible to receive donation credit for the amount the item sells for at the event, not the fair market value.

· You cannot just choose an organization and show up at the doors with your items in tow, looking for a place to leave them. Most eligible charitable organizations where artwork would be donated have committees in place to review and accept or deny potential donations. Some are only looking for items by certain artists that fille specific holes in their collections. Others have a broader scope of items they will consider. But you must contact the potential donee, ask about the process of accepting donations and get the ball rolling. This can take time. If you have waited until December to pursue a donation, you may be looking at the next tax year for the donation to occur.

Once the donation is accepted, you may need an appraisal from a qualified appraiser. Here are a few things to be aware of regarding the appraisal:

· If you are donating an item or group of related items that are less than $ 5,000, you are not required to have an appraisal. If above that amount, an appraisal is required.

· If the value of the items is above $ 5,000 but under $ 20,000, the appraisal is required but you are not required to include a copy of the appraisal with your tax filing. If the value is $ 20,000 or above, a copy of the appraisal is required to be included with your filing.

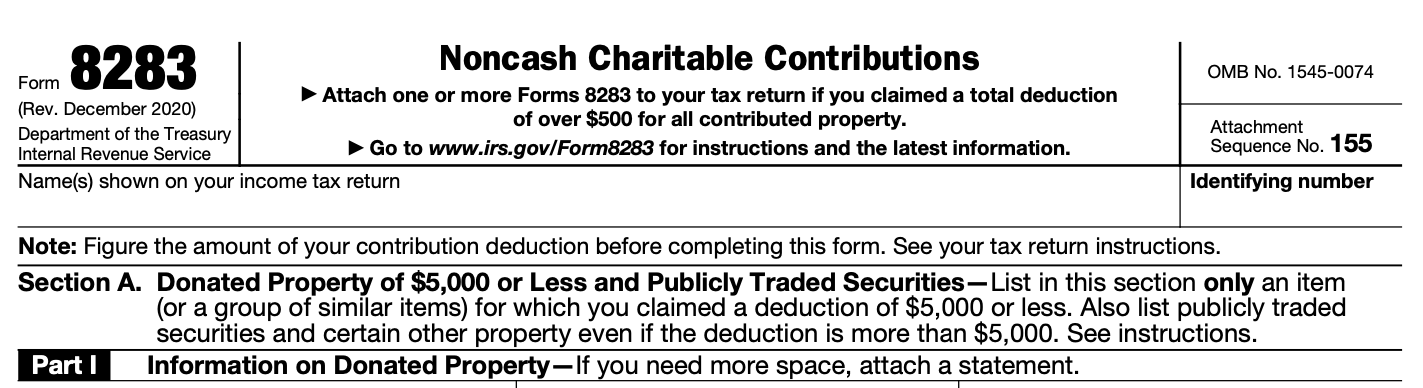

· If you are having an appraisal done, the appraiser will provide you with the form 8283 for inclusion with your taxes. This form has elements to be filled out by the appraiser, you as the donor, and the donee organization. You should take the 8283 form from the appraiser, fill out the elements that pertain to you and secure the signature acknowledging the donation from the charity.

· The Declaration of the Appraiser found on form 8283 warrants that the appraiser is qualified to appraise the items, that he/she has no financial stake in the artwork or the stated value and alerts the appraiser that if he/ she is party to gross misstatement of values within the appraisal, he could be prosecuted and or fined.

· The IRS provides a definition of who is a ‘qualified appraiser.’ Not every person who holds themselves out to be an appraiser of personal property meets the definition of being “qualified.” So, if you are considering a donation, make sure to review the Professional Profile of any appraiser you are considering. Make sure they are at the very least accredited with one of the three main personal property Appraisal organizations (ISA, ASA or AAA) and they do appraisals of the type of property you need appraised for IRS purposes on a regular basis.

· IRS appraisals are definitely subject to review. Higher value artwork will likely be reviewed by the Art Appraisal Review Board, a volunteer group of artworld professionals. Your charitable deduction can be lowered or eliminated if the appraisal is not properly prepared. For higher value artwork, the appraiser must include images of all comparable pieces considered and a full written analysis of the valuation process and conclusions.

· As the donor, you are eligible to get a tax credit for the Fair Market Value of the donated items. This type of value has nothing to do with the amount you paid for the pieces, how many years you have owned them, or the values they are carried at under your insurance.

· The IRS defines fair market value as “the price a willing, knowledgeable buyer would pay a willing, knowledgeable seller when neither has to buy of sell.” (Page 2- “Instructions of Form 8283”). Defining the appropriate marketplace in which to seek values and making credible arguments regarding the FMV of each item is the job of the appraiser. That is why you need a well-trained, seasoned appraiser!

· The appraiser you intend to engage should be willing to speak with you about the process of the appraisal and should be familiar enough with the work to be appraised to know whether their services are required. Remember, an appraisal is not necessary if the value of the donation is under $ 5,000. However, an appraiser is not ethically allowed to speak to anyone about a desired value result. A good appraiser would not even consider taking on a job with an expected value conclusion. That is strictly unethical.

When donating or downsizing your art collection, it is imperative you understand the options available to you. We understand the amount of time and emotion that goes into building a collection. That same attention is required when finding the right place to gift a piece of art.

If you are in need of an appraisal for your artwork donation, give us a call. We have written hundreds of donation appraisals over the years for our clients, many of which have gone to the IRS Art Appraisal Review Board. Our appraisals are written to the highest quality, conform to the Uniform Standards of Professional Appraisal Practice (USPAP) and to the Ethical Standards and Report Writing Standards of the International Society of Appraisers.

We would be happy to be of service.

Brenda